Transitioning from a lifelong career to life on your own terms

A never-ending story? A blessing or a curse? Questions about retirement were the main focus of AVENA’s now-traditional Biennial Conference, which was held on 9 September 2025 at the Olympic Museum in Lausanne and drew over one hundred attendees. The event was moderated by Thierry Vial, editor-in-chief of PME magazine, and featured two guest speakers: Matthieu Leimgruber, professor of history at the University of Zurich, and philosopher Sophie Galabru. The attendees also received an update on the occupational pension landscape in Switzerland, and on AVENA more specifically, from Francis Bouvier, the director of AVENA, and Catherine Vogt, the pension board chair.

Swiss pension system: an ongoing debate

How should first-pillar (AVS) pensions be funded? How should pension roles and responsibilities be divided between the government, businesses, and individuals? These questions are still being discussed a century after they were first raised, even if the debate actually took shape in the second half of the 20th century. Although many view 1947 – the year of the “AVS victory” – as the biggest milestone in the development of the Swiss pension system, Matthieu Leimgruber sees 1972 as the real turning point, when voters rejected the “Super AVS” proposal and the three-pillar system became entrenched in public discourse.

Will 2025 be another milestone for the Swiss pension system? It’s too soon to say, although Mr. Leimgruber pointed to the growing political debate surrounding the third pillar as a key development last year. Looking forward – an unusual exercise for a historian – he expressed confidence that, while retirement pensions would never go away in Switzerland, the system itself would keep evolving. “The boundaries between the three pillars and the roles each one should play will continue to be disputed,” he predicted, while acknowledging that the first pillar was the strongest in terms of popular buy-in.

Building a meaningful life after retirement

From a lifelong career to life on your terms: for philosopher Sophie Galabru, the transition to retirement can trigger an identity crisis as people leave their career behind and have to reconstruct their sense of self. It’s an abrupt shift, and it marks the start of a phase of life that has gotten longer over the years – which is why we need to proactively plan it out. For Ms. Galabru, this involves redefining our role in society, embracing aging by adopting a more holistic view of time and believing that our best days aren’t necessarily behind us, staying busy, and pursuing meaningful social relationships.

Ms. Galabru emphasized that a long retirement can bring unexpected opportunities, and reminded attendees that retirees can have big plans, too. She also stressed the importance of passing on what we consider essential, in order to give the next generation a leg up.

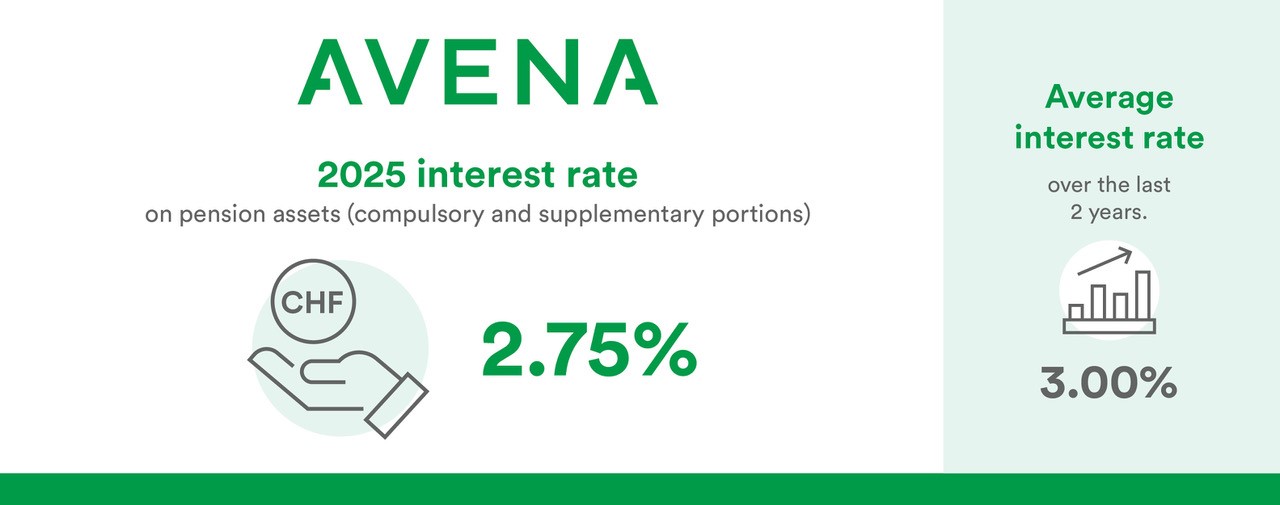

A growing pension fund

The question of timeframes also comes into play in the day-to-day management of pension funds. Francis Bouvier noted that while pension funds operate on a generational timeline and are rarely faced with urgent crises, that doesn’t mean they can tread water. AVENA, for its part, is moving forward: membership in the Fund has more than doubled in the past decade. For Catherine Vogt, the most pressing issue for occupational pension funds is the need to communicate better. She argued that pension funds should act urgently to address the second pillar’s poor public image and must fulfill their responsibility to keep all stakeholders informed of important developments.

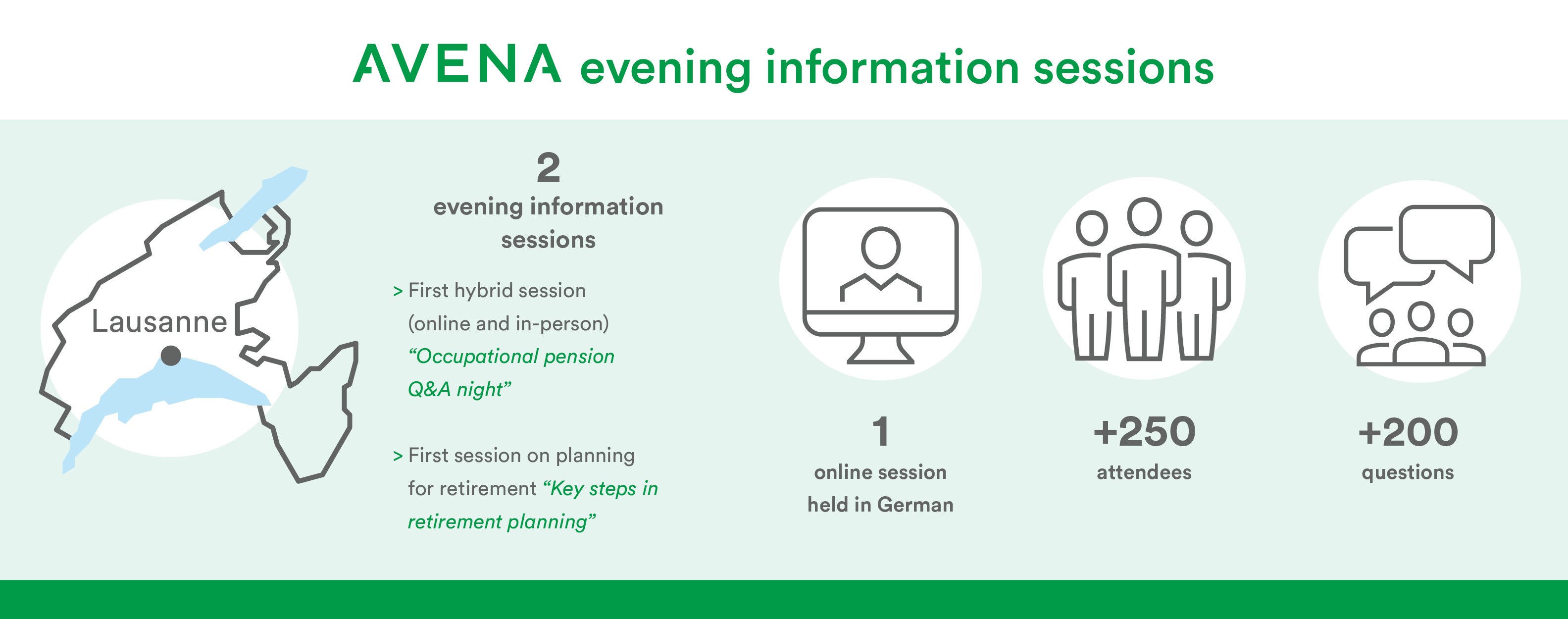

AVENA has been taking action on this front for several years now. The Fund organizes evening information sessions for its members to help them understand how the pension system works and how they can get a handle on their own pension situation. AVENA also reaches out to business owners: it has partnered with key players such as PME magazine and the Vaud Chamber of Commerce and Industry (CVCI) to discuss the challenges of occupational pensions for employers. “For any company, occupational pension contributions represent a significant portion of payroll costs. Human resources teams should use these contributions as a way to increase employer attractiveness,” Ms. Vogt said, while emphasizing the need to keep communication clear and simple.

Important updates

Good communication also involves providing important information to those who need it. Accordingly, Mr. Bouvier presented new options available to AVENA members, such as “decreasing pensions.” This feature is being offered in response to the desire expressed by some members to receive more income when they first retire and have greater financial needs, and less income after 10 years.

Regular pension or lump sum? This question has become more pressing than ever, as increasing numbers of retirees in Switzerland – possibly even a majority, according to some data – are opting to withdraw their retirement benefits as a lump sum. At AVENA, the share of retirees who choose to receive a pension has fallen from 60% in 2020 to 50% in 2024, with the remainder split between the lump sum (39% in 2024) and a mixed solution (11%).

So what should members do? AVENA is about to unveil a “retirement check-up” to help members make informed decisions. This and other resources will soon be available on a completely redesigned website.

The next Biennial Conference will be held in 2027 – the year of AVENA’s 50th anniversary, as Ms. Vogt reminded attendees.